Income Tax Return Filing

Course Description

Institute For Income Tax Return Filing in Jalandhar

Developed and delivered by industry experts, our taxation program will help you achieve your full potential in your career, your workplace, and your profession.

Amzine Taxation helps you to bring the right investment planning under 80C, manage deductions and refunds and get going with tax-filing right from registration to tax filing.

Course Summary: Income Tax Return Filing Training in Jalandhar

The design of the course is done in such a form that when a student works, he can easily fulfill the needs of the clients. Emphasis is given to each and every topic regular test is conducted. Amzine being an ISO Certified Institute the Quality of the training is always high.

- Know-how of Income Tax Filing Process

- Real assignments with varied nuances

- Understanding of all the tools and digital requirements

Course Curriculum of Income Tax Return Filing

- Basic Knowledge of Income Tax Return

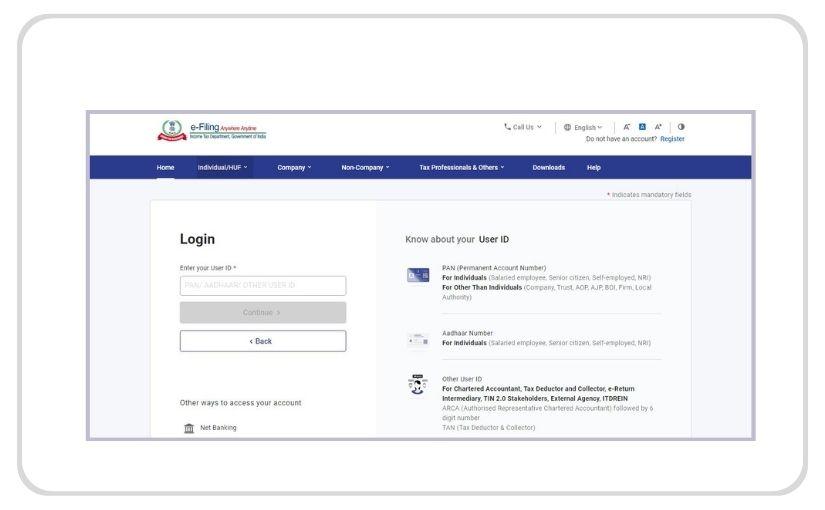

- Registering With Income Tax Site

- Understanding 26AS Form

- Request to Reset Password

- Filing of ITR -1

- Income of House Property

- Detail of 80 C Deduction

- Rebate of 80 TTA

- Exempt Income Treatment

- PAN/TAN Application

- Submission of Return With Digital Signature (DSC)

- Submission of Returns with OTP

- Concept of Self Assessment Tax/ Advance Tax

- Understanding TDS from an ITR point of view

- Adding TDS entries in ITR

- Understanding Digital Signature

- Registering for DSC

- Payment of Income Tax

- Filing of Returns

- Detailed concept on Local Sale/ Interstate Sale/ Branch to Branch Transfer

StudyLms

If you want to contact us about any issue our support available to help you 8am-7pm Monday to saturday.